Managing your business checking account with digital tools can greatly impact your bottom line. By utilizing real-time monitoring and automation, you can identify potential fees before they hit and streamline your financial processes. These tools not only enhance your cash flow management but also reduce unnecessary expenses. However, understanding the essential features and best practices is vital to fully leverage these benefits. What specific strategies can you implement to maximize your financial health?

Key Takeaways

- Digital tools provide real-time monitoring, enabling businesses to track account activity and prevent overdrafts or unauthorized transactions effectively.

- Automated alerts for low balances and upcoming transactions help businesses avoid unexpected fees and manage cash flow proactively.

- Payment automation ensures timely bill payments, reducing the risk of late fees and enhancing overall financial stability.

- User-friendly budgeting features facilitate expense tracking, allowing businesses to optimize spending and identify unnecessary costs.

- Access to fee-free ATMs within the bank’s network promotes cost savings by minimizing withdrawal fees during cash transactions.

How Digital Tools Help You Avoid Business Checking Account Fees

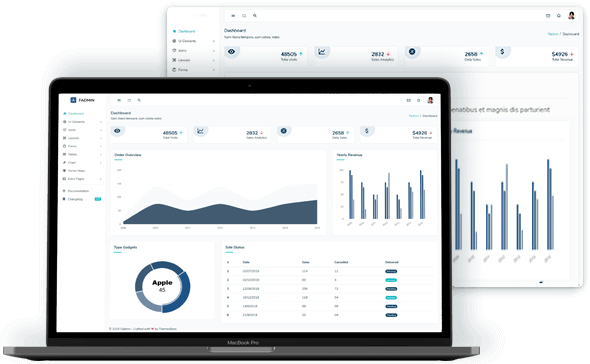

As you manage your business checking account, leveraging digital tools can greatly help you avoid business checking account fees. By utilizing online banking platforms, you can monitor your account activity in real-time, allowing you to identify any potential fees before they occur. Setting up alerts for low balances or upcoming transactions guarantees you stay informed, preventing costly overdraft fees. Additionally, many digital tools offer budgeting features, helping you track spending and maintain financial discipline. You can also automate payments, which reduces the risk of missing due dates and incurring late fees. Understanding how to avoid business checking account fees is vital to maintaining your financial health and making sure your business thrives without unnecessary expenses.

Essential Features of Digital Banking Tools to Avoid Fees

Digital banking tools come equipped with essential features designed to help you avoid business checking account fees effectively. By leveraging these functionalities, you can manage your finances with ease and confidence. Here are four key features to examine:

- Real-time transaction alerts: Get notified instantly about your account activity, helping you stay on top of your spending.

- Automated budgeting tools: Track your expenses and income, allowing you to make informed financial decisions.

- Fee-free ATM access: Locate nearby ATMs that won’t charge you extra fees, ensuring easy cash access.

- Mobile check deposit: Deposit checks from anywhere, eliminating the need for in-person visits and associated fees.

Embrace these features, and you’ll find yourself well-equipped to avoid business checking account fees.

Best Practices for Using Digital Tools to Avoid Business Checking Account Fees

To effectively avoid business checking account fees, it’s essential to adopt best practices when using digital tools. First, regularly monitor your account balance through your banking app to prevent overdrafts and associated fees. Set up alerts for low balances to stay informed. Next, utilize automated payments for recurring expenses, ensuring you never miss a due date. Also, explore fee-free ATM options within your bank’s network to avoid withdrawal charges. Leverage budgeting tools to track spending and maintain financial discipline. Finally, regularly review your account statements to spot any discrepancies or unnecessary fees. By following these best practices, you’ll maximize your use of digital tools and effectively avoid business checking account fees, fostering a healthier financial future for your business.

Future Trends in Digital Banking and Fee Management

While many businesses currently benefit from digital banking tools, future trends promise even greater efficiencies in fee management. Here are four trends you should watch for:

- AI-Powered Analytics: Expect more sophisticated AI tools that analyze your spending patterns to suggest ways to avoid fees.

- Real-Time Notifications: Stay informed with instant alerts on transactions and potential fees, allowing for quicker responses.

- Enhanced Security Features: Look for advanced security measures that not only protect your account but also reduce the risk of unauthorized fees.

- Integrated Financial Platforms: Anticipate platforms that combine banking, accounting, and budgeting tools, streamlining your financial management.

Why Managing Your Business Checking Account Can Help You Avoid Fees

As businesses increasingly adopt advanced digital banking tools, effectively managing your business checking account becomes essential for avoiding unnecessary fees. By regularly monitoring your account activity, you can quickly identify potential overdrafts or unauthorized transactions. Digital tools often provide real-time alerts, so you stay informed and can act swiftly to prevent fees. Setting up automatic transfers or scheduling bill payments helps maintain a positive balance, reducing the risk of missed payments and associated charges. Additionally, using budgeting features available in these tools enables you to track spending and optimize cash flow. Ultimately, knowing how to avoid business checking account fees not only saves you money but also fosters financial stability, allowing your business to thrive in a competitive landscape.

Conclusion

Incorporating digital tools to manage your business checking account isn’t just a convenience; it’s a strategic move to avoid unnecessary fees. By utilizing real-time monitoring, automated payments, and customizable alerts, you can take control of your finances and enhance your cash flow. Staying proactive in managing your account not only prevents fees but also contributes to your overall financial health. Embracing these digital solutions positions your business for greater stability and success in a competitive environment.

You May Also Like To Read: